TAKE PAYMENTS

with

JUST YOUR PHONE

for $29*

*No extra card reader required for NFC enabled Android devices with Android 10.0 and above. Transaction fees apply from 1.29%

Use your Android phone for card payments with our Australian developed AirpayTAP technology.

It’s safe, secure and certified by all major card schemes.

How Airpay TAP works

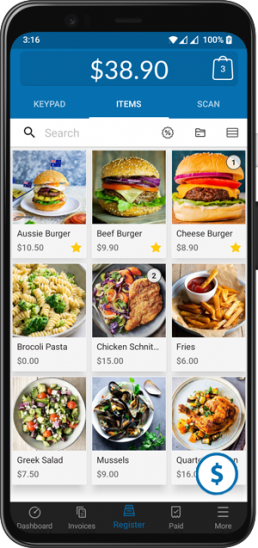

Step 1

Merchant enters amount and chooses Card payment

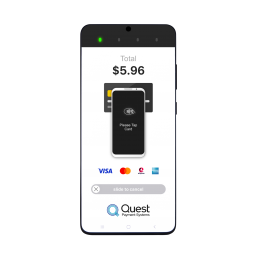

Step 2

Airpay TAP prompts for card presentation. Ask your customer to tap their card or digital wallet onto the back of your phone.

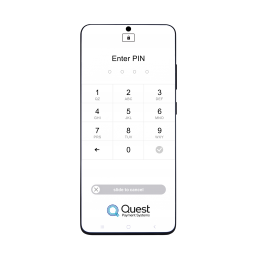

Step 3

Airpay TAP prompts for PIN entry (if required)

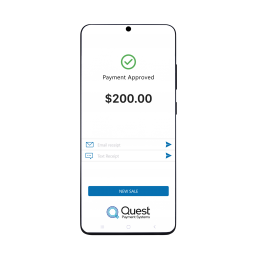

Step 4

Merchant POS app shows transaction is approved

Airpay isn’t just payments, it’s your complete business solution

Airpay provides a complete business solution from taking payments, to product management, customer management, quoting and invoicing, and sales reports. Finally, your funds are deposited into the bank account of your choice.

Everything your business needs.

Accept all payment types

Accept all payment types

Get paid anytime, anywhere, by card, cash or alternative payments. Send receipts via email or SMS.

Invoice and Quote

Invoice and Quote

Send invoices anywhere from your mobile device. Draft and Quote on-site to get jobs locked in fast.

Sales Reports

Sales Reports

View sales and invoice reports by day, week, month or quarter, even when you’re out of the office. Keep track of your best performing items and any overdue invoices.

Manage Products

Manage Products

Manage your products, services, and sales history, with in-depth support for product modifiers, discounts, and grouping.

Manage Customers

Manage Customers

Establish customer relationships and improve customer loyalty. Easily track customer purchase history.

No Android Device? No Worries!

Accept Card Payments Anywhere, In Any Way

Airpay Reader with contactless

Connects to smartphones via bluetooth, card payments through Visa, MasterCard and EFTPOS.

Tailored for your business

Airpay POS has different modes that tailors the app to match how you operate your business.

Retail & Markets

Manage your products and accept all types of payments with our app and card reader package.

General Business

Quote, invoice and take payment on site and limit your paperwork after hours.

Hospitality Beta

Manage orders for take-away and table-service with this early preview of Hospitality mode. Please test-drive it and let us know what features you would like to see.

Airpay TAP (Tap And PIN) is a Tap to Phone smart software solution that turns an NFC enabled Android smartphone or tablet into a payment terminal meaning you can tap customer’s cards and smartphones to take payments.